Tax strategy – statutory requirements

The list of entities which this tax strategy applies to can be found at Appendix 1.

Strong values have been at the heart of the organisation since its creation. They guide all Mazarians in their daily actions, providing a common base of values that all Mazars’ partners and teams share and respect. These values are detailed in Mazars’ Charter, individually signed by each CARL (equity) partner:

- Integrity

- Responsibility

- Diversity and respect for individuals

- Technical excellence

- Independence

- Continuity

1. How Mazars manages UK tax risks

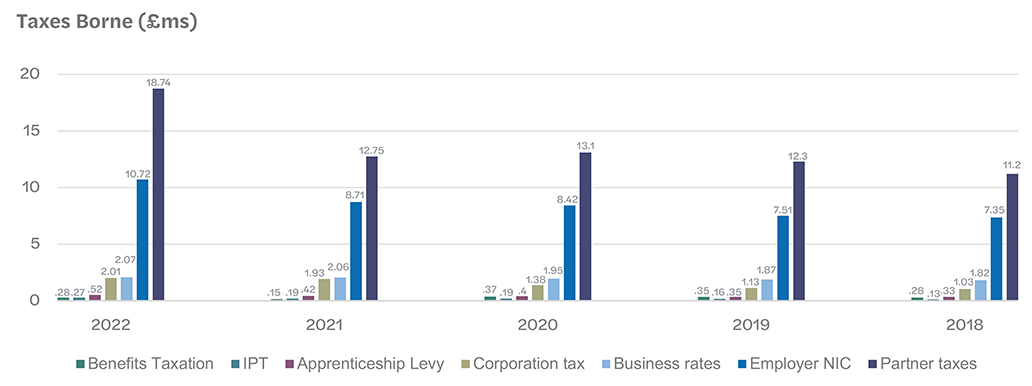

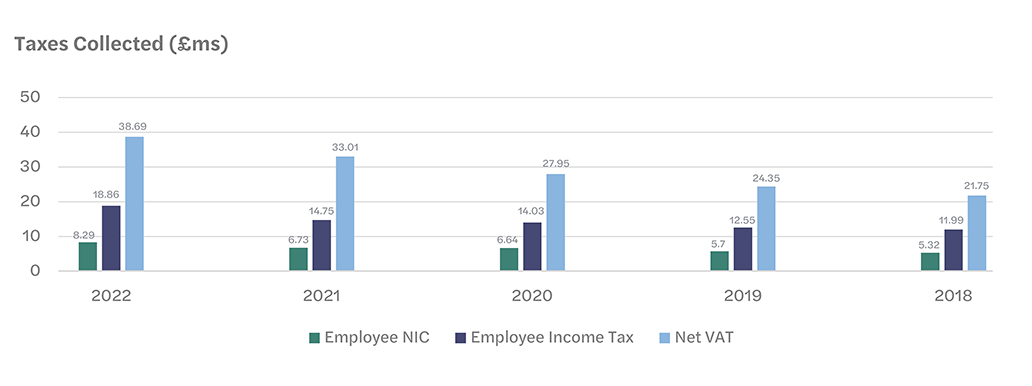

- Mazars strives to be fully tax compliant, paying the correct amount of tax in a timely manner. Mazars is generally liable to corporation tax, employment taxes, VAT, partners’ income tax, insurance premium tax and stamp duty. Appendix 2 details Mazars’ contribution to UK tax for the 2018 to 2022 financial periods.

- The Executive Board takes responsibility for the execution of the UK tax strategy, supported by a team of in-house finance and tax professionals. The day-to-day management of tax matters and compliance rests with the CFO. Working with the CFO, the Partnership Tax Group (“PTG”) meets regularly to review compliance and to address any tax issues faced by the partnership and its partners.

- VAT and payroll taxes are the responsibility of the Finance team led by the CFO and technical assistance from the wider Tax practice is requested when required. The Partnership Tax Return, any related corporation tax returns for subsidiaries and the individual partners’ tax returns are prepared by the PTG and reviewed by the Partnership Tax Manager and Partner responsible for Partnership Tax. Both of these individuals are experienced tax professionals. The CFO is responsible for signing all corporate filings, and the CFO signs the Partnership Tax Return

- The PTG takes responsibility for preparing, reviewing and submitting partner self-assessment tax returns and corporation tax returns for the Partnership’s subsidiaries. Full real time status reports on filings and relevant payments are maintained by the Partnership Tax Manager and discussed regularly with the Partner responsible for Partnership Tax and the CFO.

- A risk register is maintained by the Partnership Tax Manager and reviewed for compliance with the CFO and Finance team, covering all aspects of tax. The PTG meets quarterly to discuss any potential risk areas that are identified, and actions are prescribed if improvements are identified as being needed.

- A member of the UK Executive is included within the membership of the PTG and regularly attends the PTG meetings. Questions of tax policy and transactional advice are asked by the Executive of the PTG and are reported back.

- Reporting to HMRC outside the normal tax return process is handled by the Partnership Tax Manager, who will co-ordinate appropriate responses on behalf of the firm.

2. Our business attitude to tax planning

- In keeping with our desire to be compliant on all regulatory and legal matters, Mazars’ focus is ensuring that we are fully compliant with the spirit and wording of tax legislation, and this drives Mazars approach to tax planning. We will only access appropriate tax reliefs and incentives that are generally available to businesses. Any tax reliefs claimed or planning undertaken is required to fit with our commercial and reputational objectives and is mainly focused on removing any double taxation and major distortive timing differences.

- As all partners are required to ensure their own tax returns are reviewed and submitted by the PTG, we also ensure that individual partners comply fully with the spirit and wording of our tax principles. As from January 2021 all partner tax payments have been made centrally from the practice to HMRC to ensure that all partners’ liabilities reflect the underlying tax calculations and are paid within the required deadline.

- All partners and employees are also required to adhere to the Mazars Global Code of Conduct. The Global Code of Conduct, which can be found here, Our-code-of-conduct sets out Mazars’ overall attitude to risk.

- Mandatory training, which includes Anti-Bribery and Corruption, Anti-Money Laundering, Corporate Criminal Offence, Modern Slavery and Ethics, is provided to all partners and employees, with compliance closely monitored.

3. The level of risk the business is prepared for UK tax

- Mazars seeks to be fully compliant in its tax affairs and we require a high level of certainty over the tax that Mazars and our partners pay. Therefore, Mazars takes a conservative approach and want to minimise the risk of not meeting our tax compliance obligations.

- The current ongoing implementation of the Risk Register to meet SAO requirements has increased the vigilance in the area of identifying internal risks and has consequently reduced the risk of failure of internal controls in terms of compliance management and strengthening and widening clearly defined responsible individual and teams.

- The finance team and PTG regularly undertake available internal training from our Tax practice to ensure they are aware of developments in UK tax compliance. Outside training is also accessed in the form of regular tax issue updates.

- Advice is sought from our Tax practice when required and is generally sufficient for our requirements, so there is infrequent need to obtain external advice on tax matters, although this would be sought if required.

4. How the business works with HMRC

- Mazars treats all stakeholders in the business, including HMRC, with the respect, integrity, and professional courtesy we would like third parties to show us. In order to build a relationship of trust and respect with HMRC we endeavour to always be open, honest and straightforward with them in our dealings on tax.

- In the event of any queries, we will endeavour to address those promptly and in a spirit of cooperative collaboration with a view to resolving any disputes quickly. As noted above, if such an enquiry arises it is the duty of the Partnership Tax Manager to take control of the process of responding and to keep HMRC briefed on progress as much as reasonable. Should we make any inadvertent errors or mistakes we will endeavour to rectify them quickly once they come to our attention, providing full disclosure to HMRC of all the relevant facts.

Appendix 1

| ARX Investments Ltd – dormant | Mazars Holdings (Australia) Limited – dormant |

| Cartwright House Licencing Limited – dormant | Mazars Holdings (US) Limited – dormant |

| Competition RX Ltd | Mazars Limited |

| Hall Liddy Limited | Mazars LLP |

| Independent Women Limited – dormant | Mazars MR Limited |

| Mazars (Gibraltar) Limited | Mazars Public Sector Internal Audit Limited |

| Mazars Channel Islands Limited | Mazars Solutions Limited – dormant |

| Mazars Company Secretaries Limited – dormant | Mazars Trust Corporation Limited – dormant |

| Mazars Corporate Finance Limited | Mazars Trustee Company (London) |

| Mazars Corporate Services Limited – dormant | Limited – dormant |

| Mazars CYB Services Limited | Mazars Trustee Company Limited – dormant |

| Mazars Financial Planning Limited | Mazars UK Limited |

| Mazars GB Limited – dormant | Neville Russell Nominees – dormant |

| Mazars Global Infrastructure (US) LLC | Rowanmoor Consultancy Ltd |

| Mazars Global Infrastructure Canada Inc | Sarah Buttler Associates Limited – dormant |

| Mazars Global Infrastructure Finance (Australia) Pty Ltd | Wool Quay Nominees Limited – dormant |

Appendix 2

The tax contribution made by Mazars in the UK